Debt Planning That Works With Your Retirement Goals

Pay off debt strategically while still building your retirement nest egg—no judgment, just smart guidance

Most retirement calculators ignore debt. Most debt payoff tools ignore retirement. We bring them together. Our AI helps you find the right balance between paying down debt and saving for your future, using proven strategies tailored to your situation.

Key Features

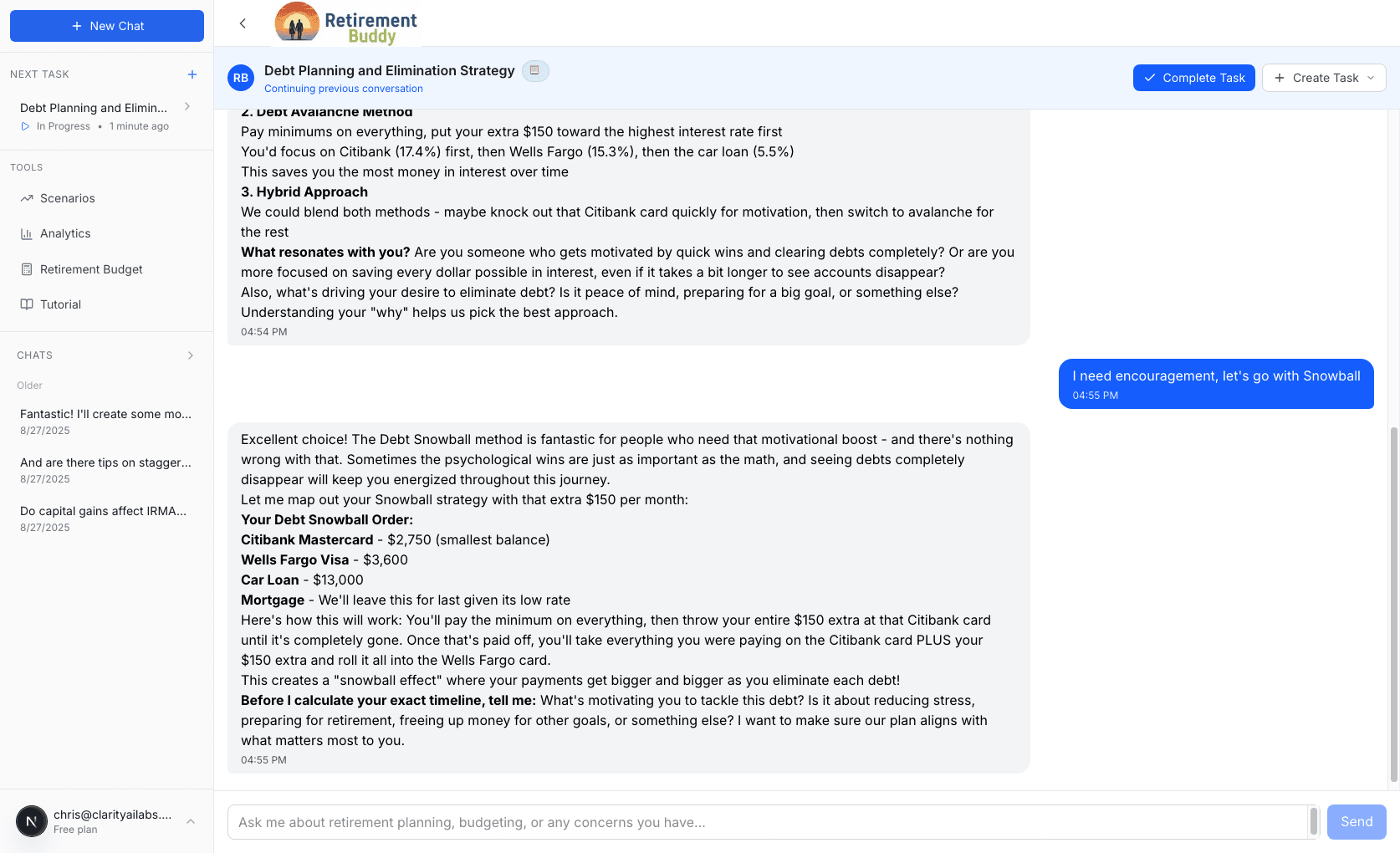

Snowball vs. Avalanche Analysis

Compare debt payoff strategies side-by-side. See exactly how much you'll save with avalanche (highest interest first) vs. the motivational wins of snowball (smallest balance first).

Retirement Integration

Understand the trade-offs: pay extra on debt or contribute more to 401(k)? We calculate the math and show you the long-term impact of each choice.

Balanced Approach

Our AI recommends the optimal split between debt payoff and retirement savings based on interest rates, employer match, and your timeline.

Judgment-Free Guidance

No shame, no lectures. Whether it's credit cards, student loans, or a mortgage, we help you make progress without sacrificing your future.

Dynamic Adjustments

As you pay down debt or your income changes, we automatically recalculate your optimal strategy and retirement projections.

Payoff Timeline Modeling

See exactly when each debt will be paid off and how different payment amounts accelerate your timeline.

Why It Matters

Make informed decisions about debt vs. retirement savings with clear math

Maximize your financial progress by optimizing debt payoff strategy

Never miss employer 401(k) match while paying down high-interest debt

See the real long-term impact of paying off debt early on retirement security

Get personalized recommendations based on your specific debt mix and goals

Automatically adjust your plan as debts are paid off or circumstances change

How You'll Use It

High-Interest Credit Card Debt

You have $15,000 in credit card debt at 22% APR and wonder if you should pause 401(k) contributions. Our AI shows you: paying minimums while keeping employer match gets you ahead long-term. The compound growth of matched contributions outweighs the interest cost. But once you're past the match, every extra dollar should attack that 22% debt.

Student Loans vs. Retirement

$45,000 in student loans at 5% APR, age 28. Should you aggressively pay them off or invest in retirement? We model both scenarios: avalanche payoff clears debt by 35 but delays retirement savings. Balanced approach (minimum payments + max employer match) leaves you $180,000 richer at 65 despite carrying debt longer. The right choice depends on your risk tolerance—we help you see the trade-offs clearly.

Refinancing Decisions

Considering refinancing your mortgage to a 15-year at a lower rate? We show you how the higher payments affect your retirement contributions and long-term wealth. Maybe the extra $500/month would compound to $300,000 in your 401(k). Or maybe paying off the house by 55 gives you the security to retire early. Our simulations reveal what works for your goals.

Debt-Free vs. Retirement-Rich

You're 45 with $80,000 in various debts and minimal retirement savings. Feeling like you should pay off everything before thinking about retirement? We run the numbers: even modest retirement contributions now, while making strategic debt payments, can mean the difference between working to 70 or retiring at 65. It's not about choosing one or the other—it's about finding your optimal balance.

Ready to Experience Debt Planning?

Start your journey to retirement confidence today—no credit card required

Get Started Free