Budget Planning That Actually Works for Retirement

Build realistic retirement budgets through conversation, not spreadsheets—plan your retirement spending with confidence

Most people have no idea what they'll need to spend in retirement. Our AI-guided budget planning helps you build a complete picture through natural conversation, creating a realistic retirement budget based on your lifestyle goals and needs.

Key Features

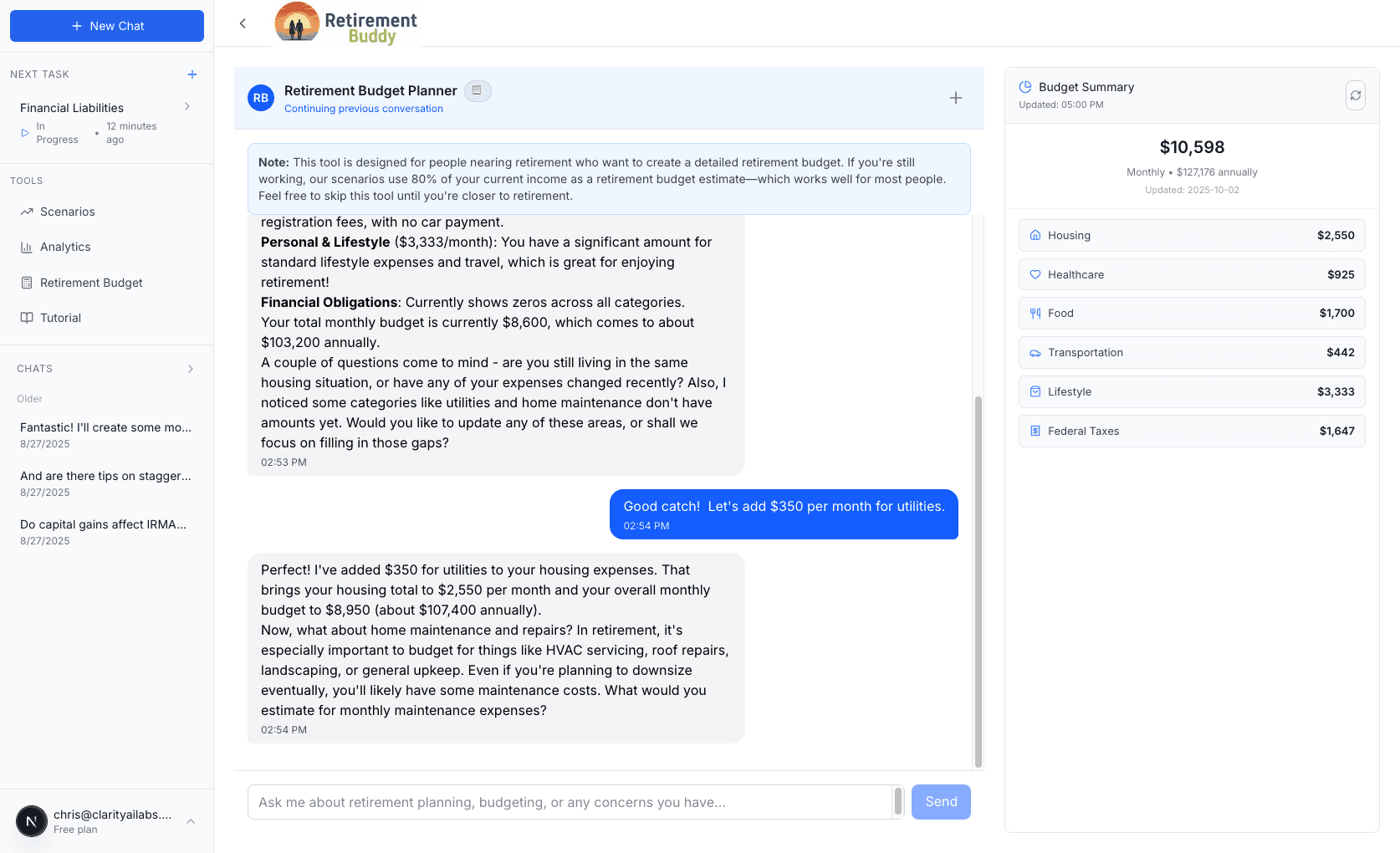

Conversational Budget Setup

Tell our AI about your life and spending. No forms, no spreadsheets—just a natural conversation that builds your complete budget.

Intelligent Category Guidance

Not sure what you spend on healthcare or utilities? Our AI suggests typical ranges and helps you estimate categories you might miss.

Comprehensive Retirement Budget

Build a complete retirement budget that accounts for how expenses change—healthcare increases, commuting ends, new hobbies begin.

Automatic Inflation Adjustments

All projections automatically account for inflation over time, so you know what "$4,000/month" really means in 10 years.

Scenario-Based Budgeting

Model different retirement lifestyles: traveling, downsizing, part-time work. See the financial impact of each choice.

Why It Matters

Build a realistic retirement budget through natural conversation

Understand how retirement will change your spending patterns

Identify spending categories that might surprise you in retirement (healthcare, travel)

Create plans based on your lifestyle goals, not generic rules

Automatically account for inflation and changing needs over time

Model different retirement scenarios to find what works for you

How You'll Use It

Building Your First Retirement Budget

Never created a retirement budget? Start with a 15-minute conversation. Our AI asks about your life, suggests categories, and helps you think through how expenses change. You'll end up with a realistic budget that accounts for everything from reduced commuting costs to increased healthcare spending.

Estimating Retirement Expenses

Not sure what you'll spend in retirement? Our AI helps you think through each category. Maybe you currently spend $4,000/month working, but in retirement: no commute saves $300, healthcare adds $500, more travel adds $400. Build a realistic picture of your retirement spending.

Planning for Lifestyle Changes

Want to travel extensively for the first 10 years of retirement, then settle down? Create multiple budget phases. Model spending $8,000/month from 65-75 for adventures, then dropping to $5,000/month after. See exactly how it affects your retirement security.

Adjusting to Market Changes

The market dropped and you need to trim spending. Which categories? How much? Our AI helps you model cuts across different areas, showing you the trade-offs and helping you maintain quality of life while protecting your nest egg.

Ready to Experience Budget Planning?

Start your journey to retirement confidence today—no credit card required

Get Started Free